Colombia's Finance Minister Indicates Suspension of Fiscal Rule

June 7, 2025 - 09:51

Colombian Finance Minister German Avila has announced intentions to suspend the country’s fiscal rule, a significant shift in economic policy aimed at providing more flexibility in managing public finances. This decision comes amid ongoing economic challenges and aims to foster growth by allowing increased public spending.

Avila emphasized the necessity for substantial interest rate cuts as part of this new approach. By lowering interest rates, the government hopes to stimulate investment and consumer spending, which are crucial for economic recovery. The suspension of the fiscal rule is seen as a response to the pressing need for economic revitalization, especially in light of global economic uncertainties.

This move has sparked a debate among economists and policymakers regarding its long-term implications for Colombia’s fiscal health. While some view it as a necessary step to boost the economy, others express concerns about potential risks associated with increased public debt. The government's next steps will be closely monitored as Colombia navigates these complex economic waters.

MORE NEWS

March 6, 2026 - 00:10

Stock market today: Dow falls more than 1,000 points, S&P 500 and Nasdaq tank as Iran war jitters return with another oil surgeA severe sell-off gripped U.S. markets, with major indices plummeting as investor anxiety over the Middle East conflict intensified. The Dow Jones Industrial Average plunged over 1,000 points,...

March 5, 2026 - 00:57

Stamford Finance Students Wow Judges, Take Home Trophy in Regional CFA CompetitionA team of finance students from Stamford has emerged victorious in the highly competitive Chartered Financial Analyst (CFA) Institute Research Challenge for their region. The team impressed a panel...

March 4, 2026 - 02:54

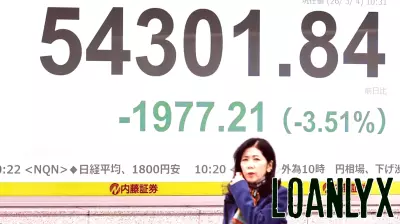

Asian shares extend losses as the war with Iran widens and oil surges higherAsian share markets extended their losses on Wednesday, mirroring a sharp sell-off on Wall Street, as escalating geopolitical tensions in the Middle East sent shockwaves through global financial...

March 3, 2026 - 19:49

Chewy Names Amazon Veteran CFO As Market Watches Margins And GrowthOnline pet retailer Chewy has named Christopher S. Deppe as its new Chief Financial Officer, a significant leadership change for the company. Deppe brings a wealth of experience from senior finance...