Strong Returns for Shareholders Over the Past Five Years

July 21, 2025 - 00:41

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. However, on a brighter note, investors in a certain financial company have experienced remarkable growth, achieving a compound annual growth rate (CAGR) of 20% over the last five years. This impressive performance highlights the potential rewards of long-term investing in well-managed companies.

During this period, shareholders have enjoyed not only capital appreciation but also the benefits of dividends, contributing to the overall return on investment. Such consistent growth can be attributed to effective management strategies, a robust business model, and favorable market conditions that have allowed the company to thrive.

As investors continue to seek opportunities in the financial sector, the success of this company serves as a reminder of the importance of patience and the potential for significant returns when selecting quality stocks. This trend raises optimism for current and prospective shareholders looking to capitalize on future growth.

MORE NEWS

March 6, 2026 - 00:10

Stock market today: Dow falls more than 1,000 points, S&P 500 and Nasdaq tank as Iran war jitters return with another oil surgeA severe sell-off gripped U.S. markets, with major indices plummeting as investor anxiety over the Middle East conflict intensified. The Dow Jones Industrial Average plunged over 1,000 points,...

March 5, 2026 - 00:57

Stamford Finance Students Wow Judges, Take Home Trophy in Regional CFA CompetitionA team of finance students from Stamford has emerged victorious in the highly competitive Chartered Financial Analyst (CFA) Institute Research Challenge for their region. The team impressed a panel...

March 4, 2026 - 02:54

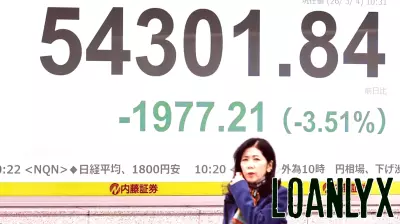

Asian shares extend losses as the war with Iran widens and oil surges higherAsian share markets extended their losses on Wednesday, mirroring a sharp sell-off on Wall Street, as escalating geopolitical tensions in the Middle East sent shockwaves through global financial...

March 3, 2026 - 19:49

Chewy Names Amazon Veteran CFO As Market Watches Margins And GrowthOnline pet retailer Chewy has named Christopher S. Deppe as its new Chief Financial Officer, a significant leadership change for the company. Deppe brings a wealth of experience from senior finance...