US Regulators Poised to Relax Treasury Ownership Rules for Banks

June 2, 2025 - 04:17

US regulators are on the verge of loosening a significant requirement that governs how banks can hold Treasury securities. This anticipated change, championed by the Trump administration, aims to enhance liquidity in the Treasury market, which is crucial for the overall financial system.

The proposed easing of restrictions represents a notable shift from regulations established in the aftermath of the 2008 financial crisis, designed to bolster the stability of the banking sector. By allowing banks to own more Treasurys, the regulators hope to create a more robust market that can better absorb shocks and provide a reliable source of funding.

Advocates for the change argue that increasing banks' capacity to hold Treasurys will not only improve liquidity but also support the broader economy by ensuring that financial institutions can more readily access capital. As discussions progress, the implications of this regulatory shift will be closely monitored by market participants and policymakers alike.

MORE NEWS

March 6, 2026 - 00:10

Stock market today: Dow falls more than 1,000 points, S&P 500 and Nasdaq tank as Iran war jitters return with another oil surgeA severe sell-off gripped U.S. markets, with major indices plummeting as investor anxiety over the Middle East conflict intensified. The Dow Jones Industrial Average plunged over 1,000 points,...

March 5, 2026 - 00:57

Stamford Finance Students Wow Judges, Take Home Trophy in Regional CFA CompetitionA team of finance students from Stamford has emerged victorious in the highly competitive Chartered Financial Analyst (CFA) Institute Research Challenge for their region. The team impressed a panel...

March 4, 2026 - 02:54

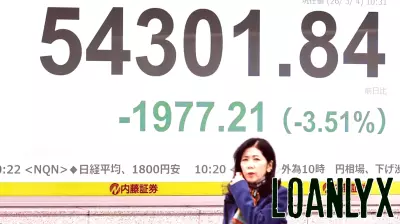

Asian shares extend losses as the war with Iran widens and oil surges higherAsian share markets extended their losses on Wednesday, mirroring a sharp sell-off on Wall Street, as escalating geopolitical tensions in the Middle East sent shockwaves through global financial...

March 3, 2026 - 19:49

Chewy Names Amazon Veteran CFO As Market Watches Margins And GrowthOnline pet retailer Chewy has named Christopher S. Deppe as its new Chief Financial Officer, a significant leadership change for the company. Deppe brings a wealth of experience from senior finance...