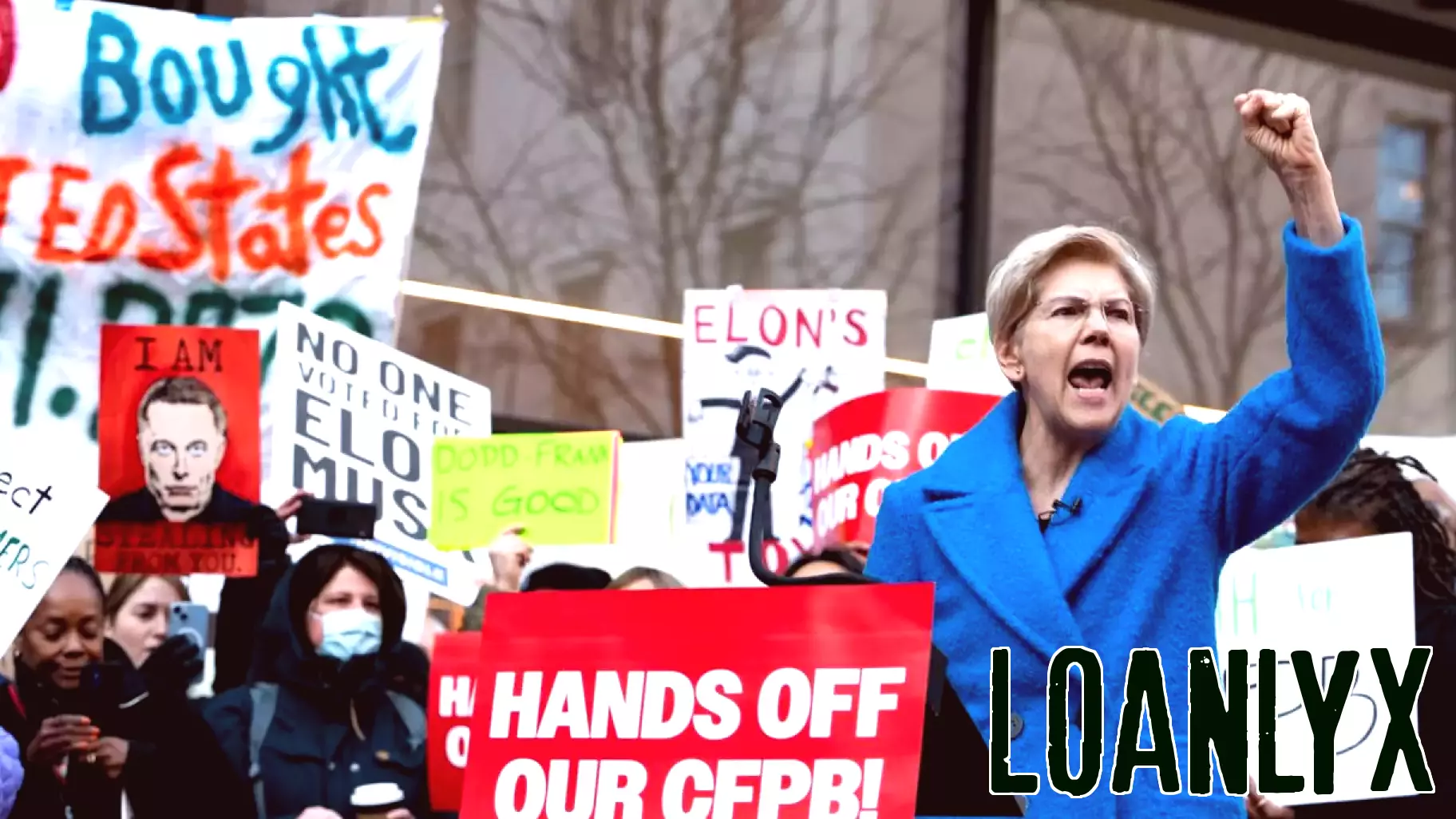

Trump Administration Undermines Financial Regulation in the US

February 27, 2025 - 16:48

The Consumer Financial Protection Bureau (CFPB), established in the aftermath of the 2008 financial crisis, has come under significant scrutiny from the Trump administration. The newly appointed director has halted all operations within the agency, raising concerns about the future of consumer protections in the financial sector. This move signals a broader shift in the administration's approach to financial regulation, prioritizing deregulation over consumer safeguards.

Industry experts fear that freezing the CFPB's activities could lead to increased risks for consumers, particularly those in vulnerable financial situations. The CFPB was designed to prevent predatory lending practices and ensure transparency in financial products. However, with its operations stalled, many worry that the protections put in place to safeguard consumers are now at risk.

As the administration continues to push for deregulation, the implications for American consumers could be profound, potentially leading to a resurgence of the very practices that contributed to the financial crisis over a decade ago.

MORE NEWS

February 25, 2026 - 02:26

Pravati Capital Partners with SEI Access, Provides Advisors with Expanded Access To Litigation Finance as Alternative InvestmentSCOTTSDALE, Ariz., February 24, 2026—A new partnership is set to broaden the availability of litigation finance within professional investment portfolios. Pravati Capital, a longstanding firm in...

February 24, 2026 - 06:05

Stock market today: Dow falls 800 points, S&P 500, Nasdaq slide as Trump's latest tariff salvo reverberates through marketsWall Street opened the week with a sharp sell-off, as former President Donald Trump`s renewed push for aggressive import taxes sent shockwaves through financial markets. The Dow Jones Industrial...

February 23, 2026 - 00:46

Walmart's AI push is leading to faster delivery times: CFOWalmart is harnessing the power of artificial intelligence to streamline its operations and enhance the customer experience, leading to significantly faster delivery times. According to Chief...

February 22, 2026 - 13:06

Los Alamos County Council Recognizes Finance And Procurement Divisions For Excellence In Fiscal StewardshipIn a recent regular session, the Los Alamos County Council formally celebrated the exceptional work of its Finance and Procurement Divisions. The teams were publicly commended for their unwavering...