Tips to Keep Your Wallet Happy During Back-to-School Season

September 4, 2025 - 18:22

Kids are back in class, and your wallets may be feeling the pinch. As parents gear up for another school year, the costs associated with supplies, clothing, and extracurricular activities can quickly add up. However, finance experts suggest several strategies to help families manage these expenses without breaking the bank.

First, creating a detailed budget is essential. By listing all necessary items and setting a spending limit, parents can prioritize their purchases and avoid impulse buys. Shopping during sales events or utilizing discount stores can lead to significant savings on school supplies and clothing.

Additionally, consider pooling resources with other parents. Organizing a swap for gently used items can help reduce costs while ensuring that children have what they need for the upcoming year. Lastly, take advantage of tax-free weekends, which can provide further savings on essential purchases.

With careful planning and smart shopping, families can navigate back-to-school expenses more comfortably.

MORE NEWS

March 6, 2026 - 00:10

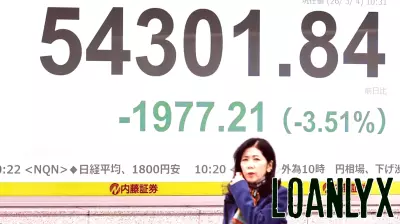

Stock market today: Dow falls more than 1,000 points, S&P 500 and Nasdaq tank as Iran war jitters return with another oil surgeA severe sell-off gripped U.S. markets, with major indices plummeting as investor anxiety over the Middle East conflict intensified. The Dow Jones Industrial Average plunged over 1,000 points,...

March 5, 2026 - 00:57

Stamford Finance Students Wow Judges, Take Home Trophy in Regional CFA CompetitionA team of finance students from Stamford has emerged victorious in the highly competitive Chartered Financial Analyst (CFA) Institute Research Challenge for their region. The team impressed a panel...

March 4, 2026 - 02:54

Asian shares extend losses as the war with Iran widens and oil surges higherAsian share markets extended their losses on Wednesday, mirroring a sharp sell-off on Wall Street, as escalating geopolitical tensions in the Middle East sent shockwaves through global financial...

March 3, 2026 - 19:49

Chewy Names Amazon Veteran CFO As Market Watches Margins And GrowthOnline pet retailer Chewy has named Christopher S. Deppe as its new Chief Financial Officer, a significant leadership change for the company. Deppe brings a wealth of experience from senior finance...