Resurgence of REITs: Strategies for Engaging with Commercial Real Estate

December 22, 2024 - 22:40

Recent signals from the Federal Reserve suggesting fewer rate cuts in the coming year have prompted a reassessment of the commercial real estate landscape. This development has acted as a reality check for investors and stakeholders within the sector. However, there is a growing belief that the commercial real estate market could witness a resurgence in momentum by 2025.

As interest rates stabilize, real estate investment trusts (REITs) are expected to play a pivotal role in this recovery. Investors are increasingly looking for ways to capitalize on the potential rebound in commercial properties, which may benefit from improved economic conditions and increased demand.

Strategies for engaging with REITs include diversifying portfolios to include a mix of residential, commercial, and industrial properties, as well as focusing on sectors that are expected to thrive in a post-pandemic environment. Additionally, monitoring market trends and regulatory changes will be crucial for making informed investment decisions. As the market evolves, the comeback of REITs could provide lucrative opportunities for savvy investors.

MORE NEWS

February 5, 2026 - 23:58

**Spotlight on Potentially Undervalued ASX Stocks This February**As the Australian stock market opens slightly lower, influenced by ongoing challenges in the U.S. tech sector and cautious global sentiment, investors are keenly observing potential opportunities...

February 5, 2026 - 08:07

Sea Limited (SE): A Bull Case TheoryA detailed bullish case for Sea Limited (SE) is gaining traction among market analysts, highlighting the Southeast Asian internet giant`s potential for sustained expansion. Trading around $126.55...

February 4, 2026 - 19:22

**Mentorship and Real-World Insight Shape Future Finance Professionals**A unique blend of Wall Street experience and academic passion is equipping the next generation of financial leaders with the tools to navigate an increasingly complex global economy. At the...

February 4, 2026 - 05:01

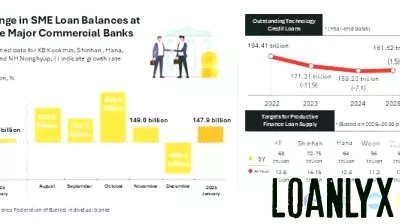

Korean Banks Shift Focus to Small Business Lending Amid Policy PushSouth Korea`s major financial institutions are actively pivoting their corporate loan portfolios toward small and medium-sized enterprises (SMEs). This strategic shift comes as the domestic...