Preparing for Potential Interest Rate Cuts: Key Strategies to Consider

August 31, 2025 - 11:09

As the prospect of interest rate cuts looms, now is the time to take proactive steps to safeguard your financial future. One crucial strategy is to lock in today's higher yields before they potentially decline. This could involve securing fixed-rate investments or high-yield savings accounts that may offer better returns in the current environment.

Additionally, reassessing your asset allocation is vital. With rates possibly falling, it may be wise to shift your investments towards assets that historically perform well in low-rate environments, such as dividend-paying stocks or real estate investment trusts (REITs). This adjustment can help mitigate risk and enhance your portfolio's resilience.

Finally, consider paying down high-interest debt. Reducing liabilities now can free up cash flow and better position you for the changes in the economic landscape. By taking these steps, you'll be better prepared to navigate the financial implications of any forthcoming interest rate cuts.

MORE NEWS

March 6, 2026 - 00:10

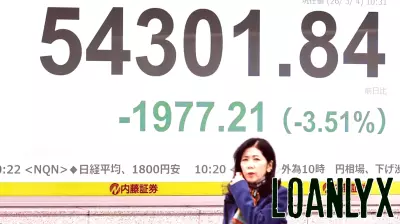

Stock market today: Dow falls more than 1,000 points, S&P 500 and Nasdaq tank as Iran war jitters return with another oil surgeA severe sell-off gripped U.S. markets, with major indices plummeting as investor anxiety over the Middle East conflict intensified. The Dow Jones Industrial Average plunged over 1,000 points,...

March 5, 2026 - 00:57

Stamford Finance Students Wow Judges, Take Home Trophy in Regional CFA CompetitionA team of finance students from Stamford has emerged victorious in the highly competitive Chartered Financial Analyst (CFA) Institute Research Challenge for their region. The team impressed a panel...

March 4, 2026 - 02:54

Asian shares extend losses as the war with Iran widens and oil surges higherAsian share markets extended their losses on Wednesday, mirroring a sharp sell-off on Wall Street, as escalating geopolitical tensions in the Middle East sent shockwaves through global financial...

March 3, 2026 - 19:49

Chewy Names Amazon Veteran CFO As Market Watches Margins And GrowthOnline pet retailer Chewy has named Christopher S. Deppe as its new Chief Financial Officer, a significant leadership change for the company. Deppe brings a wealth of experience from senior finance...