Optimism Amid Tariff Concerns: A Wall Street Strategist Predicts Market Rally

April 8, 2025 - 03:51

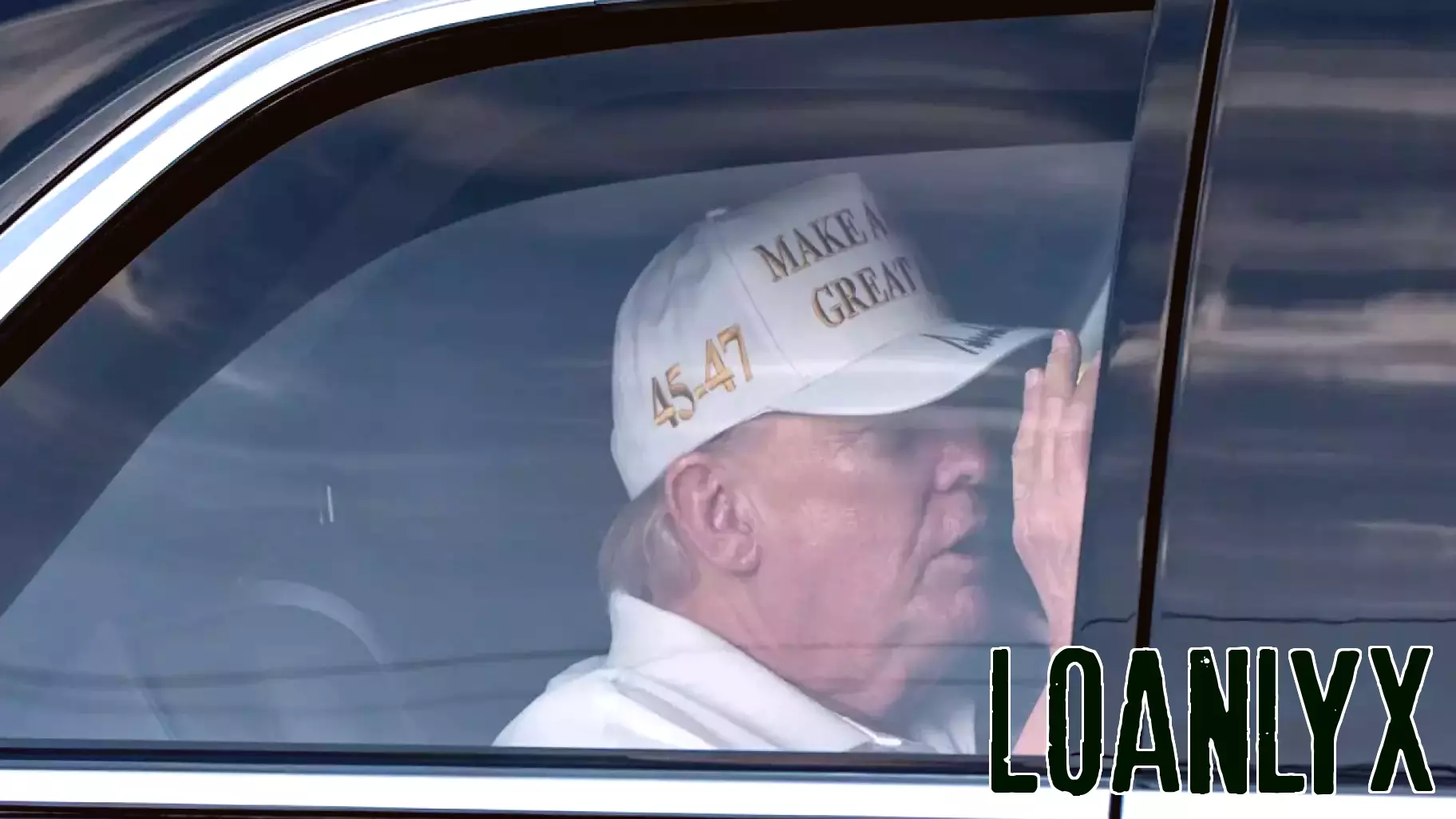

While numerous analysts on Wall Street are revising their year-end price targets downward following the recent tariff announcement, one strategist remains optimistic, forecasting a potential rebound in the stock market. This expert believes that the current levies imposed will ultimately lead to negotiations that could lower tariffs, providing a more favorable environment for investors.

The strategist argues that despite the immediate volatility and uncertainty caused by trade tensions, historical trends suggest that markets tend to recover after such announcements. The expectation is that as discussions progress, businesses and consumers will adapt, leading to renewed confidence in economic growth.

Investors are advised to keep an eye on the evolving situation, as any signs of compromise could trigger a rally. This perspective offers a glimmer of hope for those concerned about the impact of tariffs on market performance, suggesting that patience may be rewarded in the coming months.

MORE NEWS

February 25, 2026 - 02:26

Pravati Capital Partners with SEI Access, Provides Advisors with Expanded Access To Litigation Finance as Alternative InvestmentSCOTTSDALE, Ariz., February 24, 2026—A new partnership is set to broaden the availability of litigation finance within professional investment portfolios. Pravati Capital, a longstanding firm in...

February 24, 2026 - 06:05

Stock market today: Dow falls 800 points, S&P 500, Nasdaq slide as Trump's latest tariff salvo reverberates through marketsWall Street opened the week with a sharp sell-off, as former President Donald Trump`s renewed push for aggressive import taxes sent shockwaves through financial markets. The Dow Jones Industrial...

February 23, 2026 - 00:46

Walmart's AI push is leading to faster delivery times: CFOWalmart is harnessing the power of artificial intelligence to streamline its operations and enhance the customer experience, leading to significantly faster delivery times. According to Chief...

February 22, 2026 - 13:06

Los Alamos County Council Recognizes Finance And Procurement Divisions For Excellence In Fiscal StewardshipIn a recent regular session, the Los Alamos County Council formally celebrated the exceptional work of its Finance and Procurement Divisions. The teams were publicly commended for their unwavering...