Navigating the Nasdaq Correction: Smart Investment Choices

March 23, 2025 - 15:50

In times of market correction, particularly in the tech-heavy Nasdaq Composite, investors often seek opportunities to make strategic purchases. With $1,000 available for investment—set aside from essential expenses—there are compelling options to consider.

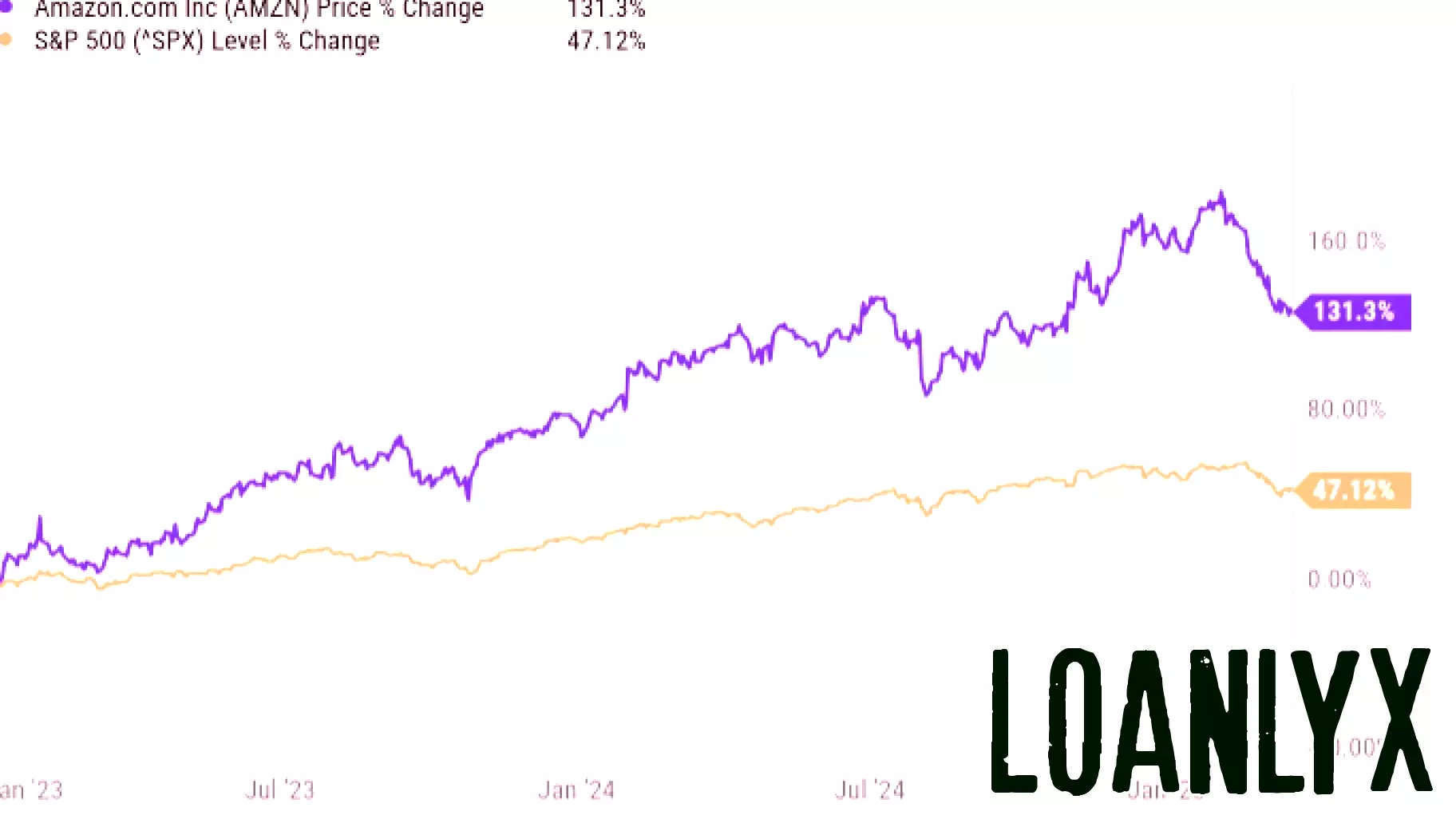

Among the top contenders are Amazon and Alphabet. Amazon, a leader in e-commerce and cloud computing, continues to show strong growth potential despite market fluctuations. Its diverse revenue streams and ongoing expansion into new markets make it a resilient choice for investors looking to capitalize on the tech sector's recovery.

Similarly, Alphabet, the parent company of Google, remains a powerhouse in digital advertising and technology innovation. With its vast array of services and products, including YouTube and Google Cloud, Alphabet is well-positioned to thrive in the long term.

Investing in these established giants during a market correction could provide a solid foundation for future growth, making them worthy considerations for those looking to maximize their $1,000 investment.

MORE NEWS

February 25, 2026 - 02:26

Pravati Capital Partners with SEI Access, Provides Advisors with Expanded Access To Litigation Finance as Alternative InvestmentSCOTTSDALE, Ariz., February 24, 2026—A new partnership is set to broaden the availability of litigation finance within professional investment portfolios. Pravati Capital, a longstanding firm in...

February 24, 2026 - 06:05

Stock market today: Dow falls 800 points, S&P 500, Nasdaq slide as Trump's latest tariff salvo reverberates through marketsWall Street opened the week with a sharp sell-off, as former President Donald Trump`s renewed push for aggressive import taxes sent shockwaves through financial markets. The Dow Jones Industrial...

February 23, 2026 - 00:46

Walmart's AI push is leading to faster delivery times: CFOWalmart is harnessing the power of artificial intelligence to streamline its operations and enhance the customer experience, leading to significantly faster delivery times. According to Chief...

February 22, 2026 - 13:06

Los Alamos County Council Recognizes Finance And Procurement Divisions For Excellence In Fiscal StewardshipIn a recent regular session, the Los Alamos County Council formally celebrated the exceptional work of its Finance and Procurement Divisions. The teams were publicly commended for their unwavering...