Major US Banks Withdraw from Climate Alliance Ahead of Potential Trump Administration

January 2, 2025 - 23:16

In a significant shift, several of the largest lenders in the United States are stepping back from a UN-backed climate initiative as the country braces for the possibility of a new Trump administration. This decision comes in the final weeks leading up to the inauguration, raising concerns about the future of environmental commitments among major financial institutions.

The banks involved have cited a variety of reasons for their withdrawal, including a changing political landscape that may prioritize economic growth over climate action. This move reflects a broader trend among financial entities that are reassessing their roles in addressing climate change, especially as regulatory environments shift.

The exit from the climate alliance signals a potential rollback of commitments made to reduce carbon emissions and invest in sustainable projects. Critics argue that this retreat could undermine global efforts to combat climate change, while supporters of the move suggest it aligns with a more business-friendly approach to economic policy. As the situation evolves, the implications for both the financial sector and environmental initiatives remain to be seen.

MORE NEWS

February 5, 2026 - 08:07

Sea Limited (SE): A Bull Case TheoryA detailed bullish case for Sea Limited (SE) is gaining traction among market analysts, highlighting the Southeast Asian internet giant`s potential for sustained expansion. Trading around $126.55...

February 4, 2026 - 19:22

**Mentorship and Real-World Insight Shape Future Finance Professionals**A unique blend of Wall Street experience and academic passion is equipping the next generation of financial leaders with the tools to navigate an increasingly complex global economy. At the...

February 4, 2026 - 05:01

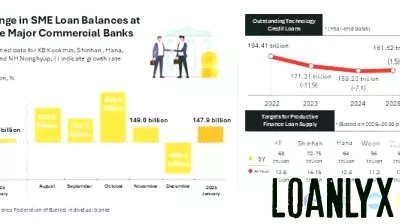

Korean Banks Shift Focus to Small Business Lending Amid Policy PushSouth Korea`s major financial institutions are actively pivoting their corporate loan portfolios toward small and medium-sized enterprises (SMEs). This strategic shift comes as the domestic...

February 3, 2026 - 23:29

Stock market today: Dow, Nasdaq, S&P 500 sink as tech falters amid flood of earningsA wave of high-profile corporate earnings reports, particularly from the technology sector, triggered a broad market selloff today. The initial optimism that carried stocks higher at the start of...