Federal Reserve Indicates Additional Rate Cuts Ahead

December 19, 2024 - 14:07

The Federal Reserve will take a more cautious approach to its easing cycle, according to the latest dot plot projections released by the central bank. The updated forecast suggests that policymakers anticipate cutting interest rates two more times in 2025, reflecting a shift in their strategy as they navigate economic uncertainties.

This decision comes amid a backdrop of fluctuating inflation rates and mixed economic indicators. The dot plot, which outlines individual members' expectations for future interest rates, shows a consensus that further reductions may be necessary to stimulate growth and support the labor market.

Fed officials have emphasized their commitment to monitoring economic conditions closely, indicating that any future rate cuts will depend on a careful assessment of inflation trends and overall economic performance. As the Fed prepares for these potential adjustments, market participants are closely watching for signals that could impact borrowing costs and investment strategies in the coming years.

MORE NEWS

February 5, 2026 - 08:07

Sea Limited (SE): A Bull Case TheoryA detailed bullish case for Sea Limited (SE) is gaining traction among market analysts, highlighting the Southeast Asian internet giant`s potential for sustained expansion. Trading around $126.55...

February 4, 2026 - 19:22

**Mentorship and Real-World Insight Shape Future Finance Professionals**A unique blend of Wall Street experience and academic passion is equipping the next generation of financial leaders with the tools to navigate an increasingly complex global economy. At the...

February 4, 2026 - 05:01

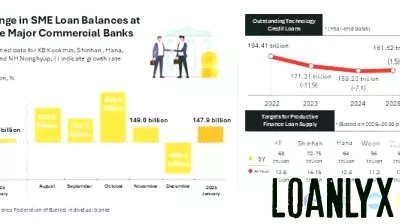

Korean Banks Shift Focus to Small Business Lending Amid Policy PushSouth Korea`s major financial institutions are actively pivoting their corporate loan portfolios toward small and medium-sized enterprises (SMEs). This strategic shift comes as the domestic...

February 3, 2026 - 23:29

Stock market today: Dow, Nasdaq, S&P 500 sink as tech falters amid flood of earningsA wave of high-profile corporate earnings reports, particularly from the technology sector, triggered a broad market selloff today. The initial optimism that carried stocks higher at the start of...