Essential Tips for Graduates of 2025: Navigating Job Search and Financial Savvy

June 1, 2025 - 03:56

As the Class of 2025 prepares to transition from academic life to the professional world, it’s crucial to equip themselves with effective strategies for securing their first job and establishing sound financial habits. A senior columnist offers valuable insights tailored to this year’s graduates.

Firstly, networking plays a pivotal role in job hunting. Graduates should leverage their university connections, attend industry events, and engage in online platforms to meet potential employers and mentors. Crafting a polished resume and tailoring it for each application can significantly enhance their chances of standing out in a competitive job market.

In addition to job searching, forming good money habits is essential. Graduates should prioritize budgeting, tracking expenses, and understanding their financial responsibilities, including student loans and living costs. Establishing an emergency fund can provide a safety net as they embark on their careers.

By combining proactive job search strategies with prudent financial planning, the Class of 2025 can set a strong foundation for their future success.

MORE NEWS

March 6, 2026 - 00:10

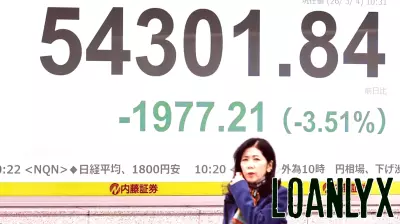

Stock market today: Dow falls more than 1,000 points, S&P 500 and Nasdaq tank as Iran war jitters return with another oil surgeA severe sell-off gripped U.S. markets, with major indices plummeting as investor anxiety over the Middle East conflict intensified. The Dow Jones Industrial Average plunged over 1,000 points,...

March 5, 2026 - 00:57

Stamford Finance Students Wow Judges, Take Home Trophy in Regional CFA CompetitionA team of finance students from Stamford has emerged victorious in the highly competitive Chartered Financial Analyst (CFA) Institute Research Challenge for their region. The team impressed a panel...

March 4, 2026 - 02:54

Asian shares extend losses as the war with Iran widens and oil surges higherAsian share markets extended their losses on Wednesday, mirroring a sharp sell-off on Wall Street, as escalating geopolitical tensions in the Middle East sent shockwaves through global financial...

March 3, 2026 - 19:49

Chewy Names Amazon Veteran CFO As Market Watches Margins And GrowthOnline pet retailer Chewy has named Christopher S. Deppe as its new Chief Financial Officer, a significant leadership change for the company. Deppe brings a wealth of experience from senior finance...