Century Next Financial Corporation Sees Significant Growth in Q2 2025

July 19, 2025 - 12:51

RUSTON, La., July 18, 2025 – Century Next Financial Corporation, the parent company of Century Next Bank, has reported impressive financial results for the second quarter ending June 30, 2025. The company, which holds assets totaling $923.6 million, experienced a notable increase in net income after tax, rising to $3.94 million. This marks a substantial improvement compared to the $3.06 million recorded during the same period in 2024, reflecting a growth of $873,000 or 28.5%.

The increase in earnings is attributed to various factors, including improved operational efficiencies and a growing customer base. The strong performance highlights the company's strategic initiatives aimed at enhancing its service offerings and expanding its market reach.

Century Next Financial Corporation continues to focus on delivering value to its stakeholders while navigating the evolving financial landscape. The positive results underscore the firm's commitment to sustainable growth and robust financial health, positioning it well for future opportunities.

MORE NEWS

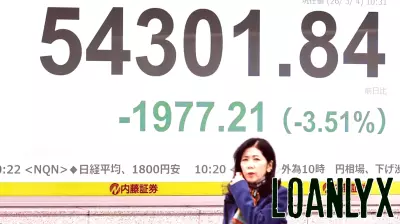

March 6, 2026 - 00:10

Stock market today: Dow falls more than 1,000 points, S&P 500 and Nasdaq tank as Iran war jitters return with another oil surgeA severe sell-off gripped U.S. markets, with major indices plummeting as investor anxiety over the Middle East conflict intensified. The Dow Jones Industrial Average plunged over 1,000 points,...

March 5, 2026 - 00:57

Stamford Finance Students Wow Judges, Take Home Trophy in Regional CFA CompetitionA team of finance students from Stamford has emerged victorious in the highly competitive Chartered Financial Analyst (CFA) Institute Research Challenge for their region. The team impressed a panel...

March 4, 2026 - 02:54

Asian shares extend losses as the war with Iran widens and oil surges higherAsian share markets extended their losses on Wednesday, mirroring a sharp sell-off on Wall Street, as escalating geopolitical tensions in the Middle East sent shockwaves through global financial...

March 3, 2026 - 19:49

Chewy Names Amazon Veteran CFO As Market Watches Margins And GrowthOnline pet retailer Chewy has named Christopher S. Deppe as its new Chief Financial Officer, a significant leadership change for the company. Deppe brings a wealth of experience from senior finance...