Aben Gold Closes Private Placement Financing

January 28, 2026 - 11:13

Aben Gold Corp. has successfully closed a non-brokered private placement financing, raising total gross proceeds of CAD $400,000. The company allotted and issued 5,000,000 units at a price of CAD $0.08 per unit, with each unit consisting of one common share in the company.

The completion of this financing provides the mineral exploration company with additional capital to advance its corporate and project development strategies. Management indicated that the funds will be directed toward general working capital purposes, which is crucial for sustaining ongoing operations and evaluating future opportunities. The private placement represents a significant step in strengthening the company's financial position as it continues to focus on its exploration portfolio.

The securities issued under this private placement are subject to a statutory hold period in accordance with applicable securities laws. The company confirmed that no finder's fees were paid in connection with this financing. This capital infusion is expected to support Aben Gold's objectives of enhancing shareholder value through the systematic exploration and development of its resource properties.

MORE NEWS

January 27, 2026 - 21:40

GM is 'specially positioned' for success, this analyst saysGeneral Motors` recent fourth-quarter earnings surpassed analyst expectations, sparking positive discussions on the company`s trajectory. According to one leading auto industry analyst, the...

January 27, 2026 - 10:53

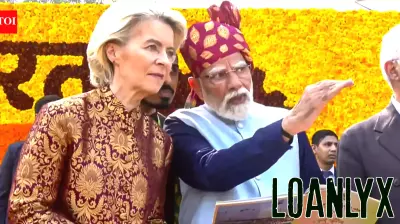

‘Europe financing war against themselves’: India-EU ‘mother of all trade deals’ draws US ire - The Times of IndiaA landmark free trade agreement between India and the European Union, poised for announcement, has sparked a significant diplomatic dispute with the United States. US Treasury Secretary Scott...

January 26, 2026 - 18:55

NEACH and Turningpoint Communications Launch Treasury and Payments Academy to Help Financial Institutions Grow Revenue, Retain Talent, and Deepen Commercial RelationshipsA new educational initiative is launching to address a critical skills gap in the banking sector. The Treasury and Payments Academy (TAPA) is a comprehensive training program created to bolster...

January 26, 2026 - 05:11

Rimes Announces Strategic Partnerships with PANTA, BMLL, and Ortec Finance to Strengthen Data and Analytics CapabilitiesIn a significant move to bolster its enterprise data management platform, Rimes has unveiled strategic partnerships with three specialized firms: PANTA, BMLL, and Ortec Finance. This collaborative...